Our Factoring

FactoringMLF Finance

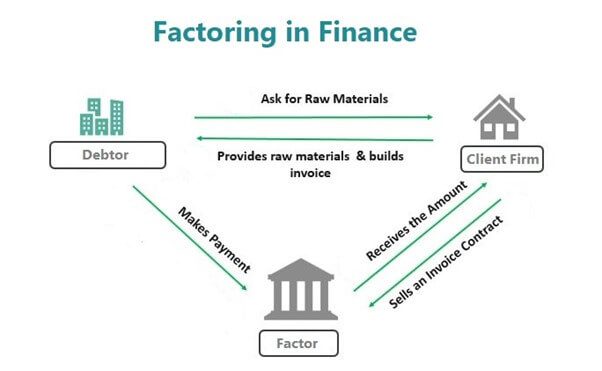

Factoring allows clients to fund their cash flow by exchanging their account receivables such as invoices for instant cash injection at a discounted rate. MLF-Finance offers a range of domestic factoring services to assist clients in improving their financial position, increasing their working capital and cash flow

We offer our clients a wide range of factoring solutions that can be tailored to meet their individual growth and business needs. We cover the financing of invoices, managing accounts receivables & payments, and collection services.

More from FactoringFactoring servicesMLF Finance

Factoring allows clients to fund their cash flow by exchanging their account receivables such as invoices for instant cash injection at a discounted rate. MLF-Finance offers a range of domestic factoring services to assist clients in improving their financial position, increasing their working capital and cash flow

Direct Factoring

Accounts receivable (A/R) factoring, often referred to as invoice discounting, is a type of short-term debt financing used by some business borrowers. The transaction takes place between a business (the borrower) and a lender (often a factoring company as opposed to a traditional commercial bank).

Reverse Factoring

Reverse factoring is a type of supplier finance solution that companies can use to offer early payments to their suppliers based on approved invoices.